Ambitious plans for South Memphis hinge on creation of a Tax Increment Financing district to pay for the improvements to the neighborhood. A few days ago, the Memphis and Shelby County Community Reinvestment Agency (CRA) put its stamp of approval on the financing tool which will result in millions of dollars of investments in the area.

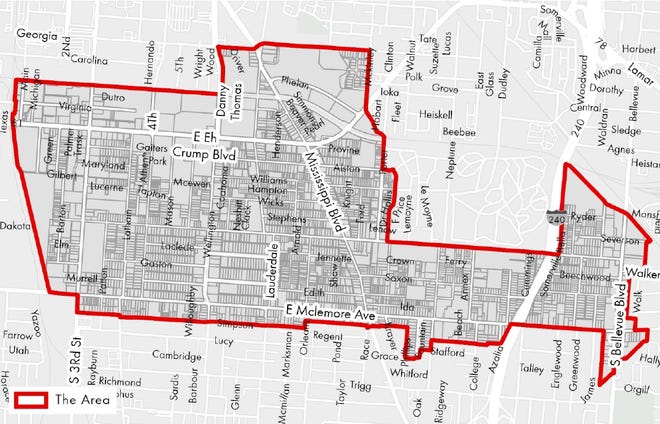

The CRA also released its map of the area that will produce the TIF and will benefit from it.

Here’s a post about the TIF that was published here on October 26, 2020:

Many of us have been waiting for an incentive that we could get excited about – specifically one directed at the parts of Memphis that really deserve help.

It looks like we finally have one – the proposed Tax Increment Financing District (TIF) for South Memphis.

I remember the grassroots leader who asked the seminal question at the Memphis City Council meeting: “Do we ever get to the front of the line when city government is giving out money?” Channel 3 put it this way: “The City of Memphis can’t seem to find the money for pre-k, but it is forking over millions for the Sears Crosstown Project.”

It is undeniable that core city neighborhoods have suffered badly from disinvestment. For decades, they have been forced to subsidize the declines of their own neighborhoods while they paid for sprawl and a city grown too big to deliver services cost effectively as its density was cut in half.

It is equally undeniable that the leaders of these neighborhoods are restive as their frustration builds because of the neglect and as they see EDGE’s Inner City Economic Development Loans average $23,438 for while six apartment developers have received $58 million in tax breaks from EDGE in only three years.

In this context, the proposed TIF District is especially welcome news.

Making The Most Of Opportunity

Here’s the rub: the best TIF needs cooperation and collaboration between a group headed by former Shelby County Commissioner and businessman J.W. Gibson, and another formed as consortium of nonprofit groups called the Soulsville-USA Neighborhood Development District.

Both groups share many of the same opinions and strategies, and while both have the right to submit their own proposal for a TIF District, hopefully, they will find common ground for moving ahead and submit the strongest possible application.

South Memphis neighborhoods have labored for a better future for decades with meager outside support. While it may have been short on money, it’s never been short on leadership. The grassroots leaders there are proud, independent, and ambitious for their struggling neighborhood.

Shelby County Commissioner Reginald Milton managed to route $250,000 to the neighborhood – where he has for 20 years managed an impressive nonprofit organization called South Memphis Alliance that grew from the relationships built at a laundromat to deliver services to its customers and more – and the money funded community engagement which produced their TIF priorities.

Meanwhile, Mr. Gibson’s business skills are readily apparent. Gibson Companies is the umbrella for his just-in-time medical, laboratory and scientific equipment distributorship, The Premier Group; a partnership for the James Lee House, a bed and breakfast without peer; a partnership for his Southeast Regional Development Corporation in renovating and reopening the Hotel Chisca; Tec-Print, a diversified printing company; and the Gibson Charitable Foundation.

Put simply, they, plus others in South Memphis, form a formidable force for change for the neighborhood they all love. Here’s hoping they can forge an alliance that puts all of these skills behind a single vision for the future.

Perhaps, it requires Mr. Gibson to sublimate a CEO’s tendency to move decisively to make a decision without talking to everybody and it requires Mr. Milton to refine grassroots’ process-laden decision-making.

The Enemy: Concentrated Poverty

Neighborhood politics can make government politics look like child’s play, but both Mr. Milton and Mr. Gibson are skilled and experienced in finding common ground. That dexterity to join hands could produce an impressive TIF application.

Even if they cannot, South Memphis is prime for a TIF as the financing vehicle for accelerating progress there, and Memphis City Council and Shelby County Board of Commissioners should make sure it happens.

In media coverage, a University of Illinois at Chicago professor cautioned that a TIF district can lead to gentrification. We won’t belabor the point except to say it’s ridiculous. Concentrated poverty is the enemy of South Memphis, not gentrification.

Between 1970 and 2010, the number of high poverty neighborhoods in Memphis climbed dramatically from 42 to 78 census tracts. Meanwhile, the population living in those census tracts increased from 93,712 to 104,140. In other words, while the number of high poverty census tracts almost doubled – 87%, the population only increased 11%.

It speaks to the historic level of migration out of Memphis neighborhoods, lured by the policies of county government that propelled sprawl and essentially required Memphians through their county taxes to pay for the decay of their own neighborhoods.

TIFs Over PILOTs

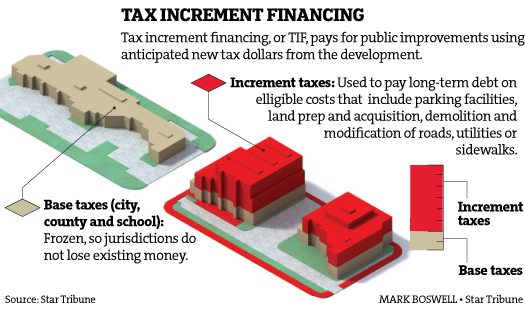

But I digress. TIF is a way for projects to self-finance. Increased property taxes created by the project are then captured – retained – and used to pay for the infrastructure the project needs. Roughly speaking, a TIF can be used to finance anything that public funds would otherwise pay for. It’s also a way to keep debt from showing up on the books of city and county governments.

But I digress. TIF is a way for projects to self-finance. Increased property taxes created by the project are then captured – retained – and used to pay for the infrastructure the project needs. Roughly speaking, a TIF can be used to finance anything that public funds would otherwise pay for. It’s also a way to keep debt from showing up on the books of city and county governments.

Cities like Chicago and Nashville have relied on TIFs as primary economic incentives rather than abatements so favored in Memphis. Chicago, in particular, has almost 140 TIF districts that have a record $926 million flowing into them.

As the Chicago Tribune, wrote in August: “That enormous sum, to be collected at a time of plummeting revenue for the city as it grapples with an economic downturn caused by the pandemic, is sure to spur another debate about whether so-called tax increment finance districts are sucking money away from where it’s needed most.

In Nashville, no TIF has ever expired, because City Council instead extended the length of the plans. A year ago, a moratorium was proposed on new TIFs and for 40% of district revenues to be diverted to the city’s school system. (School funding in Shelby County is reduced every time a TIF or PILOT is approved, estimated at about $10 million a year.)

Greg LeRoy, executive director of Good Jobs First, which tracks economic-development subsidies, says cities everywhere should consider keeping schools’ portion of property-tax revenue whole when making TIF deals. I have advocated making schools whole often.

All that said, and because we’re unlikely to kick our addiction to incentives anytime soon, I prefer TIFs because unlike PILOTs, the beneficiary is in fact paying its taxes which are being used to pay for infrastructure projects. PILOTs, on the other hand, waive property taxes altogether that they company owes, which in effect, shifts the cost of the public services and infrastructure they need to everyone else, particularly homeowners and small businesses.

The Right Question

By our count, the South Memphis TIF would bring the total in Memphis to six and it’s the easiest of them all to defend.

It’s impossible to defend the East Memphis Poplar Corridor TIF district, City Hall’s gift to Boyle Investment Company. EDGE approved a $42 million TIF district for the most affluent business district in Memphis, That application was of course accompanied by the obligatory economic impact study showing a glowing return on investment and the important need for the PILOT.

Even with the TIF district, EDGE approved a tax break of about $1.7 million for construction of a new Renasant Bank in the district. There was already the $57 million in taxes that International Paper won’t pay in the next 15 years, the $5.7 million tax break for Thomas and Betts so it could change its zip code, and the $19.5 million tax holiday for FedEx.

The Memphis Business Journal asked the right question: “Is East Memphis where we need to make our major infrastructure push, or can we get a better return in other parts of the city?”

In response, advocates of the Poplar Corridor TIF gave precisely the wrong answer: that it must be made more competitive with Nashville’s downtown business district. The right answer would be downtown Memphis.

The right answer is also South Memphis, and as it moves ahead, we hope EDGE, City Hall, and the mayor and commissioners show as much interest in it as they have in other parts of Memphis who needed a lot less help, if it needed it at all.

**

Memphis-area TIF Districts:

* Uptown Memphis

* Highland Row

* Graceland

* Shops at Millington Farms

* The Lake District (Lakeland)

* University District/Highland Strip

* Poplar Corridor

***

Join us at the Smart City Memphis Facebook page for daily articles, reports, and commentaries relevant to Memphis.

I feel that the city needs to really consider more in the TIF district to include Mason Temple as a Historic site along with its connection to Downtown and Soulsville. The Communities in between could certainly use some Redevelopment.