In our first post, we began our list of 10 things that made us who we are today.

In that post, we addressed:

* Shelby County Encourages Middle Income Families to Leave Memphis

* No Commitment to Planning

* Ignoring the Need for Equity

In the second post, we added two more:

* Lock ‘Em Up Law Enforcement

* County Government Delivers Urban Services

In our third post, we added:

* Failing to Create a Real Memphis MPO

* Chasing Population Through Aggressive Annexation

With this post, we wrap up our 10 decisions, issues, and influences that created the Memphis and Shelby County we live in. Today, we focus on “America’s Distribution Center,” “PILOT policies,” and “Unfair Tax Structure.”

America’s Distribution Center

It was a challenging time when the Memphis Jobs Conference paved the way to the adoption of “America’s Distribution Center” as our city’s tagline. It was a groundswell that led the tagline to be put on every highway signs and signs at the airport welcoming visitors to Memphis.

The Memphis economy was sputtering and city leaders were looking for the next great economic sector that would create jobs and drive growth. About eight years earlier, in 1973, a fledgling company named Federal Express had moved from Little Rock to Memphis, and with railroads, a major inland port, and its location at the hub of major east-west and north-south interstate highways, it’s easy to understand why distribution was targeted for its economic potential.

That said, Memphis did more than set this as a priority on the economic agenda. Memphis doubled down and adopted the tagline and approach that anchored the economy in low-wage and low-skill jobs. In the end, the company that would become FedEx became more than anyone could have dreamed might be thought by some to be the motivator for the city’s new moniker but in truth, it was driven more by real estate and development interests.

In Memphis, over the years, so much of our economic development priorities have more accurately been real estate development. While Memphis is rightly proud of its location, by focusing on moving boxes and freight, we set in motion a self-identity that was more about efficient distribution processing than innovation workers creating new ideas and producing them and shipping them here.

Equally important, it generated more focus on infrastructure – more and wider lanes of traffic – and propelled projects like I-269, a massively expensive project that attacks the host city at our economic heart. In essence, any road was seen as a good road.

The good news is that in recent years, business leaders have come to realize that moving freight efficiently creates the greatest value on both ends of the process, but little value to our city at its hub. As a result, there is a new emphasis on creating entrepreneurs and startups that will in fact produce products with higher value that will accrue more to Memphis’s benefit because of their economic stickiness.

It is the right movement at the right time, because continuing to emphasize low-skill jobs for distribution workers and package movers is a race to the bottom in an economy whose success is defined by knowledge workers and innovation. In fact, it is striking how many of the recent economic development announcements – like the one last week about another ED plan – is aimed at correcting many of the decisions made 30-35 years ago.

If nothing else, we need to learn how to recognize sooner that we should hedge our bets and aim higher or we embark on bad decisions based on too little data that have long-term impact on how we are seen nationally. Another illustration of this is the decision by the old Memphis and Shelby County Airport Authority to brand the airport as an “aerotropolis” when it was nothing more than a buzzword and has since become an idea on life support.

PILOT Policies

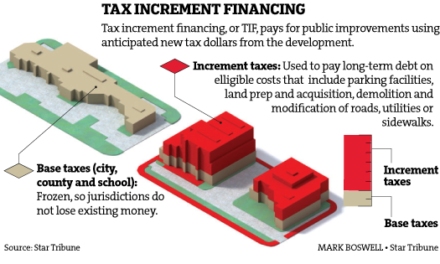

Closely connected to our focus on distribution was the public policy decision to dole out business incentives in the form of waived taxes for jobs that were decidedly low-wage and low-skill.

But the seeds of the philosophy that led to this thinking predates even “America’s Distribution Center” by generations. It stems directly from the commodity trap that stems from our background as an agricultural center in which our experience was in selling products to a consumer making a decision based on the lowest price.

Commodity economic development is premised on the same thing – appealing to companies who make their decisions based on the lowest prices. This kind of economic development is forever in a race to offer the cheapest land and the cheapest workers. Because our tradition is in businesses with thin profit margins, our economic development culture was one with an aversion to risk-taking, which in turn undercut innovation and entrepreneurship.

Cities with commodity mentalities think they can grow their economies with low wages, low land costs, low utilities, and low taxes. In a commodities world, these are seen as the factors that must be controlled to keep prices down. They are often cited as justification for the tax abatements that we hand out to any company that can complete the forms and resulted in Memphis and Shelby County approving more tax waivers than the rest of Tennessee combined.

It creates an interesting paradox. As a result of this overreliance on tax freezes, we now have businesses that complain that they have to have the PILOTs because taxes are so high here, but one of the reasons taxes are so high is the very fact that major businesses are not paying them. More to the point, with the present PILOT policies, large employers will never have to pay taxes, which means that they are sending the message that the companies that know us best don’t think we are worthy of their support for vital public services that benefit their employees and customers.

Here’s the thing: when the PILOT program was first created, it was to be temporary stopgap program to give Memphis and Shelby County a trump card in business recruitment, but it was expected in future years to become more and more selective, strategic, and infrequent. Much has changed since the PILOT program was created approximately 35 years ago, namely the underlying dynamics of the economy. In this way, the PILOT program’s roots run deep into old school economic development and it does little to respond to the need to support, encourage, and incentivize entrepreneurs who drive today’s economy.

The defenders of the status quo related to PILOTs contend that they are vital for our economic growth, but the fact is that they have been in place and become even more liberal as the Memphis economy lost the most jobs since Yellow Fever. A major review of PILOT policies has been undertaken by EDGE, and hopefully, it will produce the common sense policies and applications that we have wanted for far too long.

Unfair Tax Structure

Just as the rationale for an overly aggressive PILOT program resulted from a weak economic toolkit by State of Tennessee, so many decisions about public finances here have been shaped by the fact that Tennessee has one of the most regressive tax structures in the U.S.

That is of course exacerbated by the anti-income tax mantra that is part of our political landscape, a mantra now recklessly included as an amendment to the Tennessee Constitution. It continues a political trend that sees the “job creators” as worthy of more and more tax breaks although there is no credible research that connects these tax breaks to job creation. What the research does prove is that growth of the middle class is not the result of trickle down economics. In fact, growth of the middle class is in fact the driver of economic expansion.

In Tennessee, the more someone earns, the percentage of their income that is paid in taxes gets smaller. That’s the poster child for a regressive tax structure.

Evidence of the our current tax structure’s unfairness is striking:

• The average tax burden in Memphis for families of three earning $25,000 is 13.3% of their total income.

• For a family of three earning $50,000, the amount of the income paid in taxes is 9.1%, and those with incomes of $75,000 pay 9.2%.

• In Memphis, a family of three earning $100,000 pays 8.6%, and remarkably, families earning $150,000 pay 8.1%.

In other words, a family earning $150,000 pays two-thirds less (by percentage of their incomes) than a family earning $25,000. Put simply, in Tennessee, the more you earn, the less you pay.

Because of the state’s regressive tax structure, local governments like City of Memphis are forced to rely on two of the most regressive taxes of all – property taxes and sales taxes – for the bulk of their revenues. Attempts to create new fees are merely band-aids on a badly wounded system that now becomes the legacy of the current Tea Party Legislature.

Wrapping Up

These then are our 10 issues, decisions, and influences that have made Memphis what it is today. It leaves us with sprawl, decreasing densities, higher poverty, higher costs of government, poor self-image, and too little to spend on quality of life.

The good news is that people at all levels are working to make things better. As we have said often, the most exciting things are those that are happening under the radar and below the power structure by people who have no interest in asking for permission.

More than anything, they teach us that it is the time for everyone to get out of the stands and onto the field, working to correct the challenges in front of us. What’s particularly encouraging these days is the feeling that the business and philanthropic communities are recognizing the importance of dozens of small-scale neighborhood-based programs and a strong DIY philosophy about city-building.

We are accomplishing some exciting things, but working together and encouraging each other, we can make the 10 decisions now that will chart a positive future for Memphis. As the past proves us, we have to get these decisions right.

Note: We can think of other issues that were instrumental in shaping who we are today, but these are the 10 we decided on. We invite you to send in any additional ones that you have and we’ll post them in a few days.

Over the past 30 years leadership in Memphis clearly made numerous wrong bets on the city and region’s future. Their errors have created a real dilemma as this posting clearly outlines.

We’ve built a regressive trap and correcting even a few of these errors will be a monumental challenge. With an economy that’s largely dependent on distribution of boxes and freight, low-wage jobs, vast numbers of poorly educated unskilled workers and a declining population — it’s no wonder Memphis comes up short on entrepreneurship.

Our ongoing emphasis on “hubs” for distribution and the airport do nothing but foster low-skill jobs for distribution workers and package movers — very much a race to the bottom.

We are disadvantaged by an under educated population and by the lack of a large top-tier university here that fosters all types of education, research and entrepreneurship.

Our city’s leaders have always had an inferiority complex and a “follow me” mentality. We must get over that hedge our bets and aim higher. If not, even more bad decisions will accelerate the already rapid decline of Memphis.

Simple fact is that Republicans have done an outstanding job over the past 20 years of demonizing taxes to the point where it is common for a person to expect fully funded public libraries, fire and police depts, pothole-free roads, and free bus rides for school children while expecting to pay little to nothing in taxes.

High service/low tax is a fantasy that the Republicans have been selling across the country. And if the services are not so great, then it must be because there is too much “wasteful spending”. Sure there is some waste, but much of what they complain about is normal spending they claim to be “enraged” about. The behavior displayed when Don Sunquist simply proposed an income tax (which would have helped pay for education and infrastructure) was appalling.

Many living in the suburbs work in the City, but would resent helping to pay for the roads in the city that make their commute in and out of the city easier.

Finally, Memphis/Shelby County leadership seem to be betting on sprawling distribution complex growth to subsidize the sprawling residential growth in the county. That will not pay the bills in the long term. Subdivisions filled with McMansions are completely unsustainable in a budgetary environment of NON-explosive growth.

What more proof do we need about the inefficient design of sprawl than MATA which is highly inefficient because riders are too far spread apart and budgets can not cover the needs?

It will be an uphill climb to change many of these policies because Nashville is filled with anti-tax crusaders

Memphis is on the skids, while Nashville and its entire surrounding region are absolutely on fire with all kinds of growth and economic development.

Nashville’s success shows that having a highly diversified economy (state government, automobile manufacturing, health care, music/entertainment, publishing, tourism, along with top tier educational institutions like Vanderbilt) make a huge difference. They didn’t place all their bets on one sector like we did.

And to top it off, the Nashville/Davidson metro has far lower property taxes than does Memphis and Shelby County.

We understand Memphis’s obsession with Nashville because it is based on history and tradition, but very few cities in the entire U.S. are matching Nashville’s momentum right now, Memphis or otherwise.

Grant and WCN, you are right. It is an uphill battle and the cumulative effect of these 10 decisions has been to create a reenforcing cycle: unsustainable sprawl and the hollowing out of the core city resulted in lower property values, lower property values reduce revenues to fund quality city services, lack of quality city services results in more out-migration, etc., etc.

We’ve written this before, but if Memphis had the same property values as Nashville or vice versa, there would be no significant difference in tax rates. In a regressive tax structure where property taxes are king, the softness of Memphis’s property is a big challenge, which only gets resolved by the build-up of the urban core, the attraction of more middle income families, increased densities, etc.

This is a good post, however I can’t fully agree with your assessment of the regressive tax structure. You say “a family earning $150,000 pays two-thirds less (by percentage of their incomes) than a family earning $25,000.” That isn’t a completely fair assessment, as you paid no attention to the taxes being paid in absolute values. A family making 25k pays $3325 in taxes, while a family making 150k pays $12,150 in taxes. Thus in absolute terms the wealthier family pays about 4 times more in taxes. By focusing solely on the relative percentages of one’s income paid in taxes, it allows for misleading statements that the rich are paying less, or “not paying their fair share.”

Thanks. The regressivity or progressivity of a tax is not based on the absolute numbers. A regressive tax is one where the tax rate decreases as the income increases. For example, if a poor family pays 13.3% of their income in taxes, why shouldn’t we?

SCM-

This has been a great series.

Anon 2:17

The wealthier family doesn’t pay proportionally more in retail purchases than the poor family. Retail purchases as a share of income goes down with higher income.