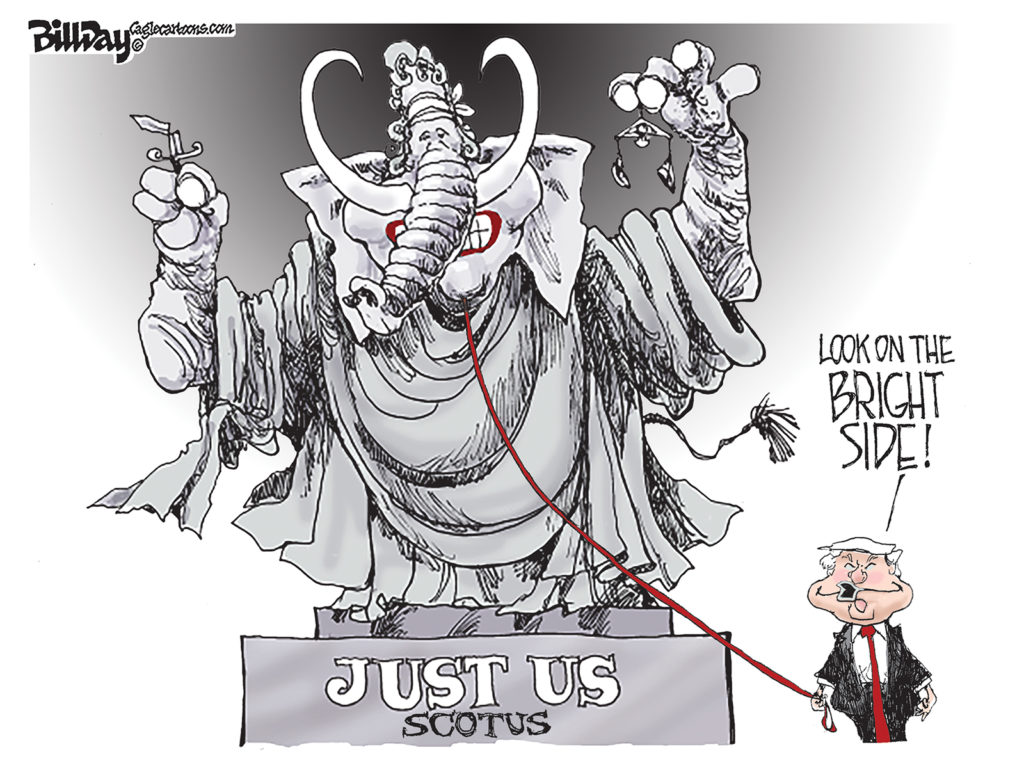

From the U.S. Capital to Memphis City Hall and Shelby County Administration Building, people with higher incomes and large corporations seem to get priority.

In Washington, a bipartisan coalition appears to have reached agreement on a $1.2 trillion infrastructure plan – at least as long as taxes are not increased on the wealthiest Americans or mega-corporations.

That’s although the proposed tax increase by the Biden Administration would still have produced a corporate tax rate lower than it was during the Reagan presidency, not to mention they had already received most of the benefit from Trump’s $2 trillion tax cut, and their incomes skyrocketed while middle class have been languishing for many years.

The pushback on an infrastructure tax increase comes at a time when Pro Publica reports that 25 billionaires, including like Jeff Bezos, Michael Bloomberg, George Soros, Elon Musk, Carl Icahn, and Warren Buffett, pay little or no taxes. As another billionaire, Donald Trump, once said, not paying taxes “makes me smart.”

Meanwhile, in April, the New York Times reported that at lease 55 of the country’s largest companies paid no taxes on billions in profits, including FedEx and Nike.

Selective Amnesia

Back here, the city and county administrations’ opposition to a property tax increase came so quickly and seemingly without any serious thought of considering other options.

Both city and county mayors swiftly said this was no time for a tax increase because these have been tough times. Of course, the fact that so many residents of our community have endured tough times could also be a logical basis for increasing taxes to make the investments for services that they need.

After all, a flat tax rate most benefits higher income homeowners.

That’s not even to mention that even in the midst of his “hold the line, we are in tough times,” rhetoric, there’s no mention of the impact of excessive PILOTs on city and county budgets so taxpayer revenue is given to huge companies like FedEx and International Paper.

FedEx spoke out against an increase of corporate taxes but that was unsurprising, considering the $17.4 billion company, over a 40-year period, will not pay its share of city and county property taxes. And it may never do it, particularly as long as the indefensible “retention PILOTs” remain in place and the cost of the public infrastructure and services it needs are shifted to homeowners and smaller businesses.

Penny Here Penny There

In the wake of the countywide property reappraisal, it would be a good time to discuss ambitions for our community and all the options for property taxes to support them, including no increase, a small increase, a more substantial increase, or a four-year investment plan with incremental increases.

In the incremental approach, a plan would be put in place that allows the public to know that small yearly tax increases would allow for better financial planning for taxpayers than the larger tax increases that eventually have to be passed after years without any.

This would particularly make sense now that the Shelby County Assessor will conduct reappraisals every two years. Another benefit is that with a multi-year plan it could reduce the political theater that emerges with each new budget.

To its credit, the Shelby County Board of Commissioners did have a discussion, even if modest, about tax rates that was more than simply affirming the state’s recertified rate of $3.45. Before reappraisal, the county property tax rate was $4.05 but in keeping with state law, it was reduced so that the rate produced the same amount of revenues, and because of the appreciation of property, the tax rate fell.

In the end, commissioners added a penny to the tax rate, which was essentially taking back the one cent from when Mark Luttrell was mayor.

In the discussion, several worthy purposes were mentioned as deserving county funding, and Commissioner Michael Whaley commented that while there is no shortage of good causes, county funding should be concentrated and of an amount where it can be transformative rather than small amounts of funding for numerous smaller amounts that lack impact.

An Investment Budget

The “moral budget” presented by a coalition of grassroots activists (and posted here May 27) have now established a context for future discussions for city and county budget hearings but this year will not produce the kind of momentum – and change – its supporters had hoped for.

Meanwhile, both governments need to adopt an investment budget approach that supports broader funding vital services with specific actions and measurements. Despite conventional wisdom, all public services in Memphis and Shelby County except for law enforcement and fire, are underfunded when compared to funding levels in comparable cities and counties.

For that reason, it would have been worth considering that half of the property tax reduction should have been used for an investment budget. For example, in Shelby County, the tax rate fell 60 cents and if one-third to one-half of that amount had been appropriated for an investment, it would have provided $30-45 million dollars in continuing funding that, to Mr. Whaley’s point, could have made a transformative difference.

But that would have required more than a kneejerk call for no tax increases which most benefits families with higher incomes.

**

Join us at the Smart City Memphis Facebook page for daily articles, reports, and commentaries relevant to Memphis and the conversations that begin here.