Thumbnail: All the popular talking points about closing the African American wealth gap would not result by doing any of them.

**

From Axios:

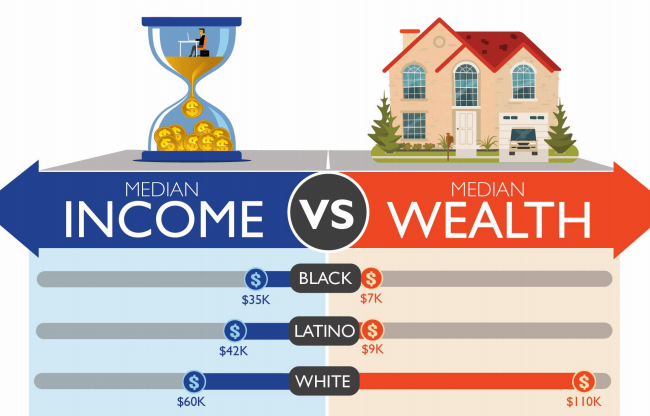

For years, there’s been a popular notion — even among some Black people — that the wealth difference between white and Black Americans could be closed if Black folks collectively “got it together.”

Reality check: The wealth gap — which could more accurately be described as a wealth chasm because of just how large it is —would not be closed by Black Americans doing any of the things that have been proposed, or all of them.

Why it matters: The argument goes that Black Americans should focus more on education, family structure and home ownership, put money in Black-owned banks, start more Black-owned businesses, increase savings and investment and generally take personal responsibility the way other “model minorities” have and that would close the wealth gap.

The fact of the matter — evidenced by decades of reporting from the Federal Reserve System, U.S. Department of Labor, Department of Commerce and various academic and professional studies — is that the wealth gap is the product of centuries of inequality and racism that has grown too large to be impacted significantly by individual actions, achievements or choices.

Here are some of the most popular myths about the racial wealth gap’s causes and solutions — and why each falls apart with a closer look.

1. The myth of closing the racial wealth gap through education

On average, Black households in the U.S. with heads who have completed a college degree have lower net worth than white households headed by someone with less than a high school education.

Why it matters: It is only after completing advanced post-college work that the median Black household surpasses the median white household’s net worth for a head with only a high school degree.

- Even then, the average Black earner has about half as much wealth as the average white earner with just a college degree.

Education also makes much less difference than being white, as Black Americans with Master’s degrees have about a 7% chance of becoming a millionaire compared to a 37% chance for white Americans, St. Louis Fed data show.

- White Americans with a high school education have about the same likelihood of becoming a millionaire as Black Americans with a Master’s degree.

2. The myth of closing the racial wealth gap through personal responsibility

As noted in a report last year by the Cleveland Fed, the income gap between Black and white Americans is the result of “persistent systemic differences in economic opportunity,” rather than a lack of responsibility.

What happened: Efforts by Black Americans to build wealth have been impeded in a host of ways, research from the Brookings Institution led by Kriston McIntosh notes, “beginning with 246 years of chattel slavery and followed by Congressional mismanagement of the Freedman’s Savings Bank (which left 61,144 depositors with losses of nearly $3 million in 1874).”

- Then there was the violent massacre decimating Tulsa’s Greenwood District in 1921 (a population of 10,000 that thrived as the epicenter of African American business and culture, commonly referred to as “Black Wall Street”).

- “And discriminatory policies throughout the 20th century including the Jim Crow Era’s ‘Black Codes’ strictly limiting opportunity in many southern states, the GI bill, the New Deal’s Fair Labor Standards Act’s exemption of domestic agricultural and service occupations, and redlining.”

3. The myth of closing the racial wealth gap through home ownership

Many have suggested that a key to closing the racial wealth gap between Black and white Americans is to encourage more Black families to own homes, but data shows that would be woefully insufficient.

Between the lines: “Rather than homeownership creating wealth, having family wealth in the first place leads to homeownership, particularly high equity homeownership,” a 2018 study from the Samuel DuBois Cook Center on Social Equity finds.

- This is borne out in the fact that Black homeowners in the U.S. on average start with much less wealth, purchase lower-priced houses and grow less value in their homes, no matter their age or income level, compared to white homeowners.

The backstory: Much of this can be traced back to U.S. homeownership history. White families were able to benefit from federal housing programs and secure mortgages for generations while Black families were often denied bank loans outright or had to accept predatory loans at extreme interest rates.

4. The myth of closing the racial wealth gap with individual accomplishment

The increasing number of Black millionaires and billionaires and the success of people like former President Obama have led many to speculate that the racial wealth gap in the U.S. is closing, but in fact the opposite is happening.

The big picture: Data shows that over the last 30 years, even as individual Black Americans have seen increased success, the overall wealth gap has widened.

What’s happening: As of 2016, 15% of white families were millionaires, according to the latest data from the Fed, compared to 7% in the Fed’s 1992 Survey of Consumer Finances.

- The percentage of Black households worth more than $1 million rose from about 1% in 1992 to a little less than 2% in 2016.

Between the lines: Fed data show that white Americans get more help accumulating wealth — 26% of white families reported receiving an inheritance, compared with 8% of Black families and 5% of Hispanics.

5. The myth of closing the racial wealth gap through increased savings

An oft-suggested reason for the massive wealth gap between Black and white families in the U.S. is that Black Americans simply don’t save or invest enough. Data shows that is untrue.

What they’re saying: A 2004 study by Maury Gittleman and Edward N. Wolff, using data from the Panel Study on Income Dynamics (PSID), tracked the financial position of Black and white families and found that if income is controlled, there is “a slight savings edge for Black households.”

What’s really happening: “The current racial wealth gap is the consequence of many decades of racial inequality that imposed barriers to wealth accumulation,” the Cleveland Fed noted in a 2019 report.

- And while white Americans’ head start in amassing wealth plays some role in the wealth gap, the primary driver for its continued presence is “persistent systemic differences in economic opportunity.”

6. The myth of closing the racial wealth gap by investing in Black-owned banks

Data: FDIC; Chart: Axios Visuals

Politicians and others have long suggested that if more Black families and businesses used Black-owned banks, it would help Black people overcome the racial wealth gap.

- However, a recent Brookings Institution report shows Black-owned firms with paid employees generated just over $103 billion in revenue annually.

What it means: If every single Black-owned business put every single dollar of its revenue into Black-owned banks every year, after a decade Black-owned banks would have 6% of the total assets that banks led by white people had in the fourth quarter of 2019.

- It would take just under 30 years of every dollar earned by all of the Black-owned businesses invested in Black-owned banks for their assets to surpass those held by one bank, JPMorgan Chase, in the first quarter of this year.

7. The myth of closing the racial wealth gap through entrepreneurship

Black Americans’ attempts at entrepreneurship are often foiled by an initial lack of capital and an inability to obtain financing, especially through government programs.

By the numbers: According to the Federal Reserve Bank’s 2016 report on minority firms, “40% of firms owned by people of color received the full amount of capital sought, compared to 68% of nonminority-owned firms.”

- The Atlanta Fed’s 2019 report on minority-owned firms found that even though Black-owned businesses were the highest percentage of firms expecting revenue growth and employment growth over the next 12 months, they were significantly less likely to get loans.

Reality check: “A review of national and regional studies over several decades indicates that limited financial, human, and social capital as well as racial discrimination are primarily responsible for the disparities in minority business performance,” a 2017 report (the latest available) from the Department of Commerce’s Minority Business Development Agency finds.

8. The myth of closing the racial wealth gap through financial literacy

A recent CNBC article suggests financial literacy is the “critical link” that could “help bridge America’s racial wealth gap.”

What it means: The focus on financial literacy generally points to disproportionate use of services like payday lending and check cashing stores with fees and interest payments much higher than traditional lending or banking options by Black folks.

- However, a 2017 report from the St. Louis Fed finds: “[M]eager economic circumstances — not poor decision making or deficient knowledge — constrain choices and leave asset-poor borrowers with little to no other option but to use predatory and abusive alternative financial services.”

9. The myth of closing the racial wealth gap by emulating “model minorities”

A prevailing myth about the wealth gap between white and Black Americans is that it could be closed if Black people valued hard work and education like so-called model minorities, typically Asians and other recent U.S. immigrants.

Reality check: Data shows that to be untrue. A 2014 Bureau of Labor Statistics study finds that across races in the U.S., “Once families decide to invest in their children’s higher education, little difference exists in the level of expenditures between racial and ethnic groups.”

The big picture: The success of recent immigrants and “model minorities” has much to do with U.S. immigration laws. Since 1965, the U.S. “has given preferential admission to those with higher-than-average levels of education; white-collar, professional, and technical employment; and thus household incomes,” University of Texas history professor Madeline Y. Hsu wrote in 2015.

- Even as newcomers, “‘successful’ immigrant groups actually retrieve a comparable class position as the one they held in their country of origin,” the Samuel DuBois Cook Center on Social Equity notes.

State of play: The wealth gap has widened despite the fact that Black Americans increased their holdings of financial assets — an often-suggested remedy — to 96.7% in 2016 from 63.5% in 1989.

10. The myth of closing the racial wealth gap through “stronger families”

Often the increased rate of Black single motherhood or “Black family disorganization” is referenced as a reason for the gap in wealth accumulation between Black and white Americans.

By the numbers: “Compared to both white and Hispanic women, Black women marry later in life, are less likely to marry at all, and have higher rates of marital instability,” a 2015 study posted to the National Institutes of Health library finds.

- And marriage clearly helps increase family wealth. Data show that married Black women have substantially more wealth than single Black women.

Yes, but: “[W]ealth differences among white and Black women persist despite type of family structure, marriage, age, or education,” the DuBois Cook Center’s study finds, tracking data from the Panel Study of Income Dynamics.

The bottom line: “[N]either marriage, a college education nor a lifetime of work provides the answer for equalizing opportunity between Black and white women.”

**

Join us at the Smart City Memphis Facebook page for articles, reports, and commentaries relevant to Memphis and the Memphis region.