As I blogged recently, there’s no research that is more useful than the Memphis Poverty Fact Sheet and other data from Dr. Elena Delavega, professor at social work at University of Memphis, who now issues the fact sheets with her husband, Dr. Gregory Blumenthal, principal at GMBS Consulting.

As valuable and dependable as the data are, what we also admire about Dr. Delavega is her willingness to interpret them in ways that challenge conventional wisdom, that provide new perspectives on old challenges and shape the understanding of public policy.

We were reminded of this when had a conversation with her for an article for a Memphis news outlet.

Here’s Dr. Delavega in her own words:

“Two things are happening. Projects are being incentivized like FedEx to move from east to downtown. We don’t look at accountability and what’s needed.

“Then, companies from outside Memphis are not providing supports for low-income housing. They scoop up housing in blocks – $10,000, $15,000, $30,000 houses while a person in Memphis cannot get a loan. The CRA (Community Reinvestment Act) mandates banks to reinvest in the community but when low-income people ask for loans, the reinvestment is not happening. Wealthy corporations scoop up land and create rentals with minimal cosmetic work.

The Mistreated Poor

“One of the things that happens when people buy houses, they buy into the community. They create roots. They are invested in schools, parks, their entire communities

“Places have been abandoned. Imagine if PILOT dollars weren’t given to large companies but instead were used for loans for low-income people. We have an expansive community but there’s not money being spent where it’s needed. We need to coordinate transit, housing, and jobs together. Funding transit can’t be overstated because poor people live far away from companies getting PILOTs.

“There are three things to do. “One, 30% should be reserved for low-income housing (when incentives given to a company). Two, there should be a strong requirement that favors people. Give it to the people, not foreign corporations. Three, rather than give PILOTs to companies, give PILOTs to people in the form of a $30,000 loan for a house. It’s so very little. Banks could make money on those.

“We have dismissed the poor. The poor are mistreated in ways wealthier people are not. The people paying $700 or $800 in rent are ignored. Living conditions are worse in low-income apartments because of service and maintenance issues. We have three or four families living in a two-bedroom apartment because there’s nothing really affordable for them. They are paying $800 a month for crappy rentals.

It’s Really Not This Hard

“If you gave someone a $30,000 loan and everything being equal, and we treat lower income people like middle and upper classes, they could pay $170 a month for a $30,000 house.

“Why is the city not underwriting loans? Imagine if $90 million was put into loans. It could help 3,000 families. Poor people are paying $800 a month for a crappy rental when for one-fourth of that, they could have their own house.

“When Crosstown Concourse was built, there was a lot of talk about low-income housing, but there are no low-income apartments there. A person that is low income, according to the definition of the CRA Act is if you make below 50% of the AMI (Area Median Income) for the region, you are low income. If you earn 50-80% of AMI, you are considered to have moderate income. If you say someone is making $25,000 or so (considered low income), what about $13,000? If someone is working fulltime, 52 weeks a year, at minimum wage, they make $15,000. The distance between $15,000 and $25,000 is large.

“We are not really looking at apartments for people in poverty. How we define low-income is getting fuzzy. We push the poor to places of no opportunity. Jane Jacobs said that when people are integrated, services for the poor are what the middle class get.

Keeping Memphis From Dying

“Another thing is that people say poor people don’t pay taxes, but they pay much higher taxes (than people with more income) and get a lot fewer services. People over 25 can get EITC (Earned Income Tax Credit), and if they are doing everything right, they get $500 a year. The poor most consistently pay taxes and consistently get little services.

“If we don’t make sure everyone is taking part in the economy, Memphis will die. Why do we want Memphis to be the warehouse of the country? Do we want Memphis to be looked down upon?

“One thing nonprofits talk about is, we need metrics. The metrics are there. The question is, are we creating equity? Right now, I give Memphis an F, failing. After almost 10 years, we’re not any better and perhaps doing worse. Hispanics are doing so much better. Memphis is more segregated than it was in 1972.

“One thing is fascinating. Take zip code 38104, Cooper-Young and Orange Mound. It looks like it’s doing well, but one is very white and wealthy and one is very black and poor. What are we doing as a city?”

We Did It In The Past

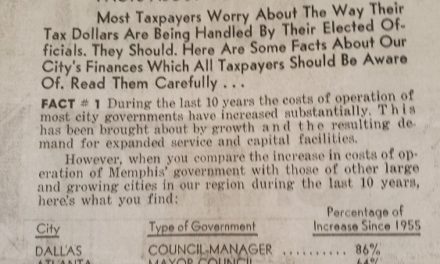

As I listened to Dr. Delavega, I thought of the Shelby County Revolving Home Loan Fund that was created in 1987 as part of the $200 million bond issue paid by the wheel tax. It was $35 million set aside to pay down housing loans. It was established as a revolving fund so that money was coming into the program so it could create incentives for more houses.

The program was a success, but some years later, the county government had a budget crunch and the finance director dumped the revolving home fund into the general operating fund budget. County Mayor Bill Morris was furious when he found out, but it was after the proposed budget had been submitted to the county commissioners and he had given his budget speech.

To my knowledge, the $30 million program is the largest investment by local government ever spent on housing. That’s a discouraging story considering it was more than 30 years ago. Now, housing programs here are generally based on whatever local government receives from state or federal funding.

While Dr. Delavega’s call may seem like a pipe dream to some, it is being done in cities like Charlotte. In August, the Charlotte City Council approved a new “Framing for Building and Expanding Access to Opportunity Through Housing Investments,” and in November, voters passed at referendum $50 million for its housing trust fund.

A Visionary Bond Issue

According to its housing plan, Charlotte needs 24,000 more housing units for residents earning 50% of the AMI or less. It launched the plan because of a confluence of housing costs rising faster than incomes, a housing market that limits homeownership opportunities for low-income people, and expectations of historic population growth.

At least two out of three of these apply to Memphis, and Memphis 3.0 predicts that the city’s population will increase by 10% by 2040. However, the Memphis population has been the same for 50 years.

The 50% AMI for Memphis amounts to $23,100 for one person, $26,400 for two people, $29,700 for three people, and $32,950 for four.

In addition to the $50 million for housing, the $223 million bond issue approved by Charlotte voters also included $118.1 million for transportation and $55 million were neighborhood improvement bonds.

In the past 16 years, Charlotte has issued an additional $124 million in bonds for housing. There, the newspaper said it is a sign of enlightened leadership. Dr. Delavega lays out a persuasive case for a similar program here.

**

Join us at the Smart City Memphis Facebook page for daily articles, reports, and commentaries relevant to Memphis.