As we watch local government officials who can’t seem to get the facts straight or understand Tennessee law regarding the local option sales tax, we keep thinking they should just call journalist Jimmie Covington, who understands all of the nuances in the law. Recently, he has been leading a one-man crusade for the facts through his comments to news articles. We’ve found them helpful and repeat them here:

If the media were really interested in what the state’s local option sales tax law requires as far as division of the revenue, reporters would contact the County Technical Assistance Service or the Municipal Technical Advisory Service or both. They both are operated by the University of Tennessee.

Under the law, the county’s “fair share” is one-half of the revenue collected in the unincorporated area of the county. There is no way a countywide local sales tax referendum can be held at this point other than one to reduce the tax rate. The only future local sales tax referendum that can be held on increasing the tax would be in the county’s unincorporated area only. Approval by voters there of a half-cent increase would make the countywide rate 2.75 percent.

If that were to occur, the one-half cent that now applies to the suburban municipalities and Memphis would all be affected in the same way. The local sales tax was authorized by the state’s 1963 Local Option Revenue Act and there has been no change in the distribution of the revenue since there. I think it is safe to say at this point that there will be no change in how the funds are split.

And…

Bottom line, the only issue before the County Commission is whether commissioners want to schedule a referendum in the unincorporated area for the voters in that area to decide whether to extend the one-half cent increase to the area. If the voters approved the increase, the increase would become countywide and the state would distribute the revenue as outlined in state law. The effect would be that half of the revenue from the current one-half-cent city-only rates in the suburban municipalities and in Memphis would be shifted to schools and be divided among the systems on an average daily attendance basis.

And…

Adding a little more on the political issues facing County Commission members: Do commissioners who represent the areas that include the suburban municipalities want to let the voters in the unincorporated area decide on whether to change the distribution of the revenue from the half-cent increase that voters in the municipalities approved in 2012? And since Memphis voters have just spoken and said they approve a half-cent increase in Memphis to restore public safety benefits and the other reasons outlined in the city referendum, do County Commission members whose districts are in Memphis want to let voters in the unincorporated area make the decision on shifting half that new revenue to schools? Memphis voters in the past have rejected proposals for a sales tax increase to increase school funding.

And…

Some history on the local option sales tax in Memphis:

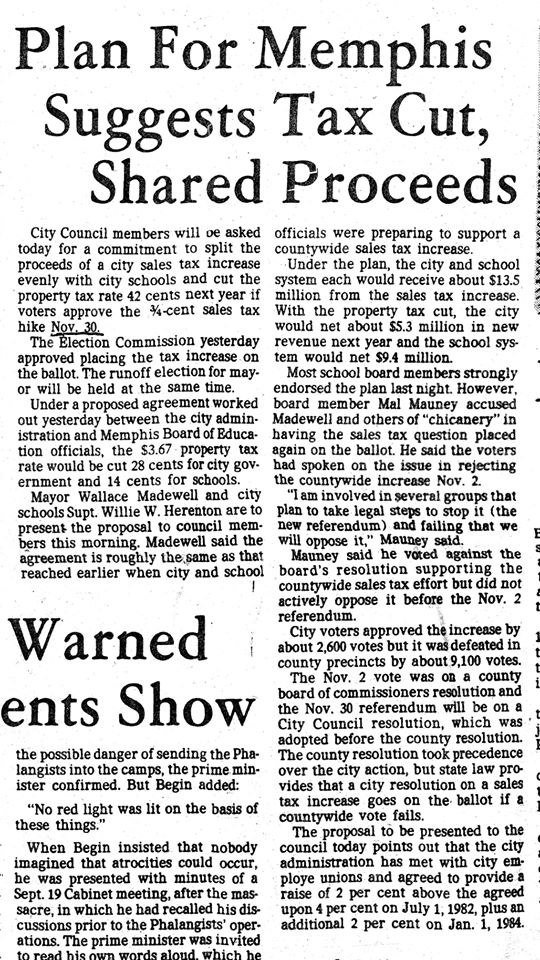

The last time a Memphis-only local sales tax increase was approved by the city’s voters before the recent successful effort by Memphis firemen and policemen to win passage of a half-cent increase to restore public safety benefits was on Nov. 30, 1982. That was carried out by Memphis city school leaders, employees and supporters working jointly with top Memphis officials with the support of city employees who had been promised an extra pay raise. The campaign also included a promise of a significant city property tax cut which was carried out as pledged.

The vote came less than a month after voters countywide rejected the proposed three-fourths (3/4) cent increase because of a lack of support in the county outside Memphis. Acting city Mayor Wallace Madewell noticed that the proposal had passed within the city and moved quickly to put a city resolution, which had been superseded by the county’s resolution, on a city special mayor’s election runoff ballot.

The city-only increase was approved by a large margin. Another county referendum was held a year later. Under state law, this county vote was limited to the county outside Memphis. The major issue was providing a funding increase for the then county school system. There was little impact on city funding because under the city schools-city officials agreement city schools received half of the city-only sales tax revenue. When the tax increase became countywide, most of the city system’s city-only sales tax revenue was replaced by the system’s share of the countywide tax. On this year’s sales tax increase, the City Council and mayor rejected the request of the police and fire associations to put the sales tax increase on a referendum ballot. However, association leaders discovered that state law allows a proposal for a local option sales tax increase to be put on the ballot by a petition signed by voters. The leaders decided to circulate petitions. After gaining enough signatures to be certified, policemen, firemen, their families and supporters turned out at early voting location and at the polls on Oct. 3. The public support of former Sheriff and former Memphis Police Director Bill Oldham provided an obvious boost. All of this tied into the support that the public safety employees have in the community.

The clipping is of a story that ran in November 1982 before the Nov. 30 vote. It carries no byline. Some of the information was from me and some was from the City Hall reporter at the time, whose name I do not recall. I do not remember which one of us wrote it. Another is a story by me from Aug. 17, 1984, several months after the county referendum passed in November 1983. The problem that then county Supt. Ward Harvey, who is now deceased, was talking about worked itself out in a few months.

And…

The county referendum in 1983 is the only time a local sales tax increase has been approved by voters in a referendum scheduled by the Shelby County Commission (or its predecessor the County Court) since the first county sales tax of 1 percent was approved in the early 1960s and a one-half percent increase was adopted in 1968. Memphis voters’ recent approval of a half-cent increase to restore public safety benefits was only the second time in history that the city’s voters have approved a Memphis-only increase. The only other local sales tax increases approved in Shelby County came in 2012 when voters in the six suburban municipalities approved a one-half percent increase to help fund new school districts in their cities. Memphis and Shelby governments have placed several other referendums on the ballot, most of them dealing with providing more funding for schools, but voters rejected the increases called for in all of them. Voters rejected proposed sales increases in county referendums in 1975, 1982, 1990 and 2012 and a Memphis-only increase in 2013.

The clipping at the start of this posting is of a story that ran in November 1982.