Paint and polish can only gloss over the problems of the Shelby County Jail, which is housed in an antiquated building unfit for its present use.

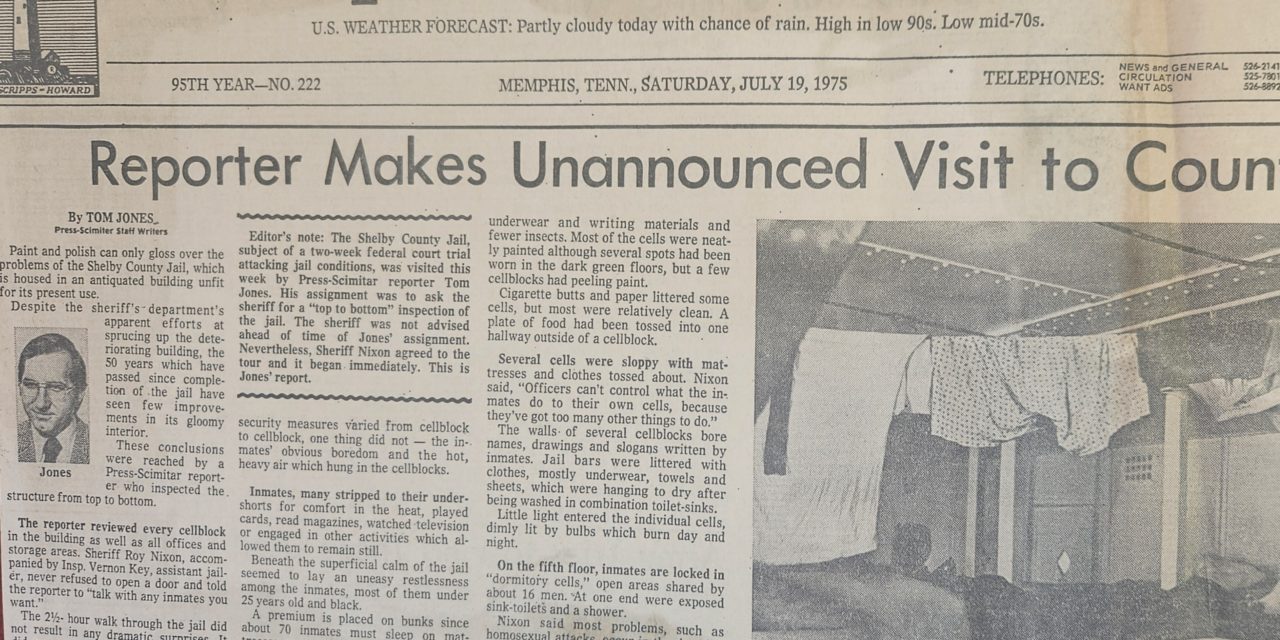

It was July 19, 1975, and that was the lede on the play story I wrote for the front page of the Memphis Press-Scimitar. It was my report on my “top to bottom” tour of the jail, a tour Shelby County Sheriff Roy Nixon allowed without any advance notice.

That opening paragraph almost 49 years ago could easily be written today about conditions of today’s current Shelby County Jail. Photographs and videos released in recent days offer compelling, uncontestable proof that county government cannot delay any longer in constructing a new facility.

In one of life’s ironies, some years after writing about my tour of the 1925 Shelby County Jail, I found myself as chair of the Shelby County Jail Building Committee whose job was to keep the $82 million project on time for its opening in 1981.

The Current Shelby County Jail

The final fortress-like, monolithic jail and criminal justice buildings characterize our communities’ general disinterest in architectural quality of public facilities (think Leftwich Tennis Center and Memphis Youth and Special Events Center) and it is testament to selections of architects and contractors being made through a political process. In the case of the Criminal Justice Complex and Shelby County Jail, it resulted in the selection of architects with no experience in designing jails but important experience as political contributors.

Because of it, the monolithic buildings had issues from its opening days.

The system of pneumatic tubes that was supposed to save time and increase efficiency went on the blink and technology problems surfaced but most concerning was the reality that the jail design had heavy personnel requirements – and the attendant heavy labor intensive costs.

Today’s discussion about a new jail echoes former Shelby County Mayor Mark Luttrell’s call for a better facility. At that time, county government’s struggle with its bonded indebtedness and its associated debt service payments prevented any action along with that board of commissioners to knee jerk oppose most of what Mr. Luttrell pursued.

It turns about Mr. Luttrell was right. The jail continues to house mentally ill individuals, as evidenced by recent photographs of a prisoner in a cell with handprints of feces covering its wall. All county government has done with its delay is to drive up costs and to allow jail conditions to deteriorate. And clearly concerns about bond debt is no less today than they were during the Luttrell Administration, exacerbated by the fact that there are no easy answers for how to pay for a new jail.

Signs of Desperation

County government’s desperation is showing, giving birth to the politically volatile idea of increasing the sales tax for eight years to 10.75% from its present rate and with the money designated to pay only for a new jail. Today, the tax rate is 9.75% except for the unincorporated part of Shelby County where it is 9.25%.

There’s a draft bill from county government setting out these terms headed to the Tennessee Legislature and its hard to see how a body that prides itself on never raising taxes will eagerly join in although it requires an affirmative vote at referendum in Shelby County to go into effect.

State laws on sales taxes today require half of the local option sales tax revenues to go to schools and half to the government for the area where the taxes originate. Each of the towns in Shelby County and Memphis have passed a .5% increase in sales taxes, and in the towns, the revenues are supposed to be spent to support their school districts.

Herein lies a potential issue. In unincorporated Shelby County, the sales tax rate is 9.25%. The proposed bill would raise the countywide sales tax rate to 10.75% but does mean that the rate for sales in the unincorporated area would automatically rise to the 9.75% rate for the rest of Shelby County. If sales tax in that area is increased by .5%, it would mean that the special sales taxes for schools passed by the towns would no longer remain in those cities but instead, all the sales tax money for schools collected in the entire county would then be pooled and allocated proportionally to each school district, which would likely mean that the towns’ school districts are likely to have less sales tax money for schools and Memphis and Shelby County School District would likely receive more.

A Looming Debt Crisis?

All that aside, Shelby County Government’s capital needs could produce a debt crisis unlike anything it’s faced since it approached the edge of bankruptcy brought on by its spending to support sprawl back when county government was incentivizing people to move out of Memphis. Ultimately, the suffocating debt was addressed by Shelby County Mayor A C Wharton who developed a disciplined plan to decrease the debt and limit new capital spending.

It was successful, and for the most part, Shelby County has adhered to that Debt Reduction Plan ever since although last year it exceeded the preferred limit of $75 million with $165 million in new bonds for various capital projects, including schools.

Total outstanding long-term debt was projected to be $926.5 million on June 30, 2023. In this year’s budget, the amount allocated for debt service payments is $188,764,466. Put another way, out of every dollar of property tax, 15.7 cents are spent on debt service.

The County Commissioners approved a $25 wheel tax increase to produce about $17 million a year dedicated to paying debt service on bonds for Regional One Health and two school projects. The first phase of the Regional One Health is projected to cost $350 million so the wheel tax increase is only a band-aid that will not cover the entire debt service for those projects.

It is likely that the county’s bond debt will increase, but along the way, financial officials will wring their hands and treat Shelby County’s bond rating as sacred and act like paying the difference between a bond rating of AA+ or AA or A is a back breaker (although commissioners are unlikely to ask what the difference would be).

Bigger Problems Than The Jail

Shelby County officials have said the cost of a new Shelby County Jail is $500 million but that is merely a ballpark estimate. For example, Jackson County (Kansas City, Missouri, is building a new jail for $301 million, and it’s for a jail that is only one-third of the size needed here (the county jail holds more prisoners than the state prison systems in more than a dozen states.

Meanwhile, in Kansas City, its city government opted not to join in on the jail project and instead it’s building its own.

Before the current Shelby County Jail was built, City of Memphis had its own jail. It was closed as part of an agreement with Shelby County that required city funding for the adjacent criminal justice complex garage. Perhaps as part of its due diligence for funding a new jail, Shelby County should revisit its agreement with City of Memphis. If Memphis built its own jail, that could allow county government to construct a smaller jail or in lieu of that, perhaps it’s time to ask Memphis to help pay for an updated jail.

The problem for county government is that a new jail is not the only large investment it needs to make. The ultimate cost of a new Regional One Health is $850 million, Memphis and Shelby County Schools has more than $500 million in deferred maintenance and new construction needs, and a significant bill for improvements to FedExForum is looming.

It’s discouraging to watch how Shelby County Government looks for magic answers to pay for these public needs instead of developing a comprehensive financial plan to cope with the big ticket items coming its way, a plan that includes an increase in the county property tax rate.

Look To The Property Tax For Help

Shelby County Government treats a higher property tax rate as an option that can never be considered. That’s although the current property tax is significantly lower than it was just a few years ago. Meanwhile, the Memphis property tax rate is at a three-decades low.

For example, a 10-cent increase in the property tax rate would bring it to $3.49. It was $4.37 eight years ago. Ten cents of property tax produce $23,313,269 in revenues which could pay for roughly $257 million in bonds.

A 10-cent increase for a median owner-occupied house value in Memphis would cost homeowners $3 a month.

As part of the evaluation of options to pay for a new jail and the other expensive projects, it’s time for county government to get realistic about the county property tax rate. It’s a kind of hypocrisy to refuse to consider an increase when $40 million in property taxes are waived every year in business incentives. That’s enough money to pay debt service for $444 million.

**

Join us at the Smart City Memphis Facebook page and on Instagram where these blog posts are published along with occasional articles, reports, and commentaries that are relevant to Memphis.