We thought of Cosmo Castorini in Moonstruck as City Council talked about the proposal to build a publicly-funded garage in Overton Square: “It costs money because it saves money.”

City government may appear to be saving money if it turns down the $6 million garage, but in the long-run, the decision will cost much more in lost revenues, lost opportunities for reviving the area, and lost new revenues that could pay for the garage and put more money in city coffers.

In listening online to the persuasive explanation given about the project by Councilmen Jim Strickland and Shea Flinn and the discussion at the City Council committee this week, one thing seemed clear: yes, the Overton Square price tag has gone up, but it’s not the developer who’s making that happen. Rather, it is the cost of the city’s detention structure (as part of the garage) that’s driving the cost up, and it’s enough to cause some suspicious Lick Creek Coalition members to worry that it’s all designed to put the idea of a detention basin in the Greensward of Overton Park back on the table.

We don’t see that happening because of the general distaste for an idea that once again put engineering ahead of quality of life.

Vibrant Again

Back when City Council approved the funding resolution to close the gap in funding for Beale Street Landing, $6 million was added for Overton Square – $4 million for the garage and the rest for the Lick Creek detention structure. Those amounts now stand at approximately $6.3 million for the garage and $8.3 million for the Lick Creek flooding solution

The added cost for the garage comes from the addition of a third level of parking spaces that are needed for Overton Square to become a theater district that would add Hattiloo Theater to Playhouse on the Square and the new Playhouse on the Square building.

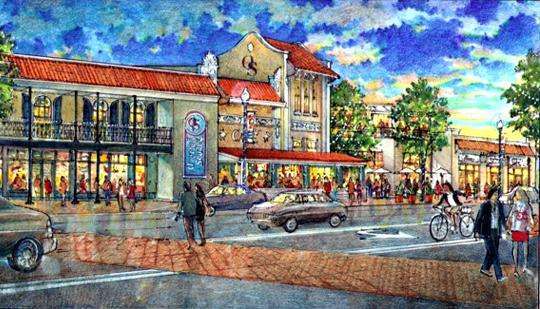

At the Council meeting, someone suggested that the plans by Loeb Properties for Overton Square will return the area to its former glory, but that’s faint praise for what could really happen there. It could in fact exceed what it was back in the day when it was the hot spot for Memphians to congregate.

Based on Loeb Properties’ presentation at Playhouse on the Square in early October, the company has a vision for a district that extends beyond the footprint of the old Overton Square, and based on rumblings on the street, there are already hoteliers and retailers ready to join in if the original vision is pursued.

That original vision hinges on construction of a garage, whose yearly debt service is less than $500,000 a year. Put that cost against the $2.4 million in new sales tax, $400,000 in new property taxes, and $19.2 million investment by Loeb Properties, and it sounds like a bargain.

It’s Tough Out There

Put these are tough times for city budgets, but from just city government’s point of view, even after new sales tax revenues are split with state government (at least until the Fairgrounds Tourism Development Zone is created and then they will stay here rather than go to Nashville) and after property tax revenues are split with county government, there’s more than $1 million a year in new city revenues. Or put another way, the pay back on the city’s investment is about six years.

Unfortunately, local government doesn’t have much latitude in earmarking new revenues to a specific cost (absent the use of a vehicle like the TDZ or Tax Increment Financing), but we do remember when Shelby County Mayor Jim Rout identified an increase in county liquor taxes and associated it to pay for a county project. With the revenue upside apparent at Overton Square, the garage construction isn’t so much a public cost but an investment that pays dividends in a short period of time, and the good news is that city government has been thinking in this entrepreneurial way with recent projects.

It’s unfortunate that media coverage of the Overton Square revitalization leaves the impressions with some that the developer gave one amount for the Overton Square project and tripled it months later. Some coverage even said Loeb Properties requested the $18 million, but that’s not the case.

The breakdown, as we understand it from the Council discussion, is roughly this: $6.3 million for garage (adding the third level to service Hattiloo Theater’s needs), $320,000 for land purchase for Hattiloo Theater as part of a theater district, and $8.3 million for the city’s detention structure. The balance is for infrastructure upgrades and streetscaping needed to create the kind of environment that’s needed for success.

Licked Creek

Put another way, it’s not the developer who’s requesting money, much less more money, for a Lick Creek detention structure. It’s City of Memphis, and we’re assuming that the fourfold increase may be as simply explained as this: the original $2 million was a very rough estimate given in the midst of a City Council meeting and was not meant to be a rigorous cost estimate.

We feel for Memphis Mayor A C Wharton, because it’s déjà vu all over again for him. When he was elected county mayor, he inherited bonded indebtedness of almost $2 billion, most of it spent with few questions to fuel unsustainable sprawl. His challenge was further exacerbated by refinancings by previous mayors that pushed the balloon notes to Mayor Wharton’s desk.

Now he has debt problems at City of Memphis and another balloon note looming in the not too distant future. However, unlike the sprawl-inducing debt of Shelby County Government that often resulted in six figure bond issuances, Overton Square is a modest opportunity to reinvest inside the Parkways, to increase the density that makes public services more efficient and economical, and to create desperately needed new revenues and economic generators for city government.

Investing Where It Helps

City of Memphis has a pre-Wharton and pre-present Council history of aiding and abetting sprawl with developer-friendly land use decisions in the city’s extraterritorial area and to do it with little regard for a payback that is positive for City of Memphis. Part of the argument in those years was that sprawl was economic growth and that we should take it wherever we could find it, but now we see it for what it was: a historic relocation of people from the urban core and the weakening of the city’s tax base.

It’s not easy to face tough budget realities and still make the investments that help bring back the core city, but if Memphis is to change its trajectory, it has to do it. The good news is that the concept of reinvesting in Memphis is more widely understood now than it was 20 years ago, and that’s why it’s so encouraging to see city government embark on several fronts to create new economic engines and new revenues. As the mayor has said, city government can’t just cut budgets and increase taxes to deal with its fiscal woes. It must also support, nurture, and grow new revenues and businesses.

That’s the opportunity with Overton Square, and for clear-eyed practical reasons – and not just nostalgia to relive our misspent youths – it’s the smart investment for Memphis to make.

Sometimes it is hard to know what issues are on the table. Memphis needs this project for two good reasons. Overton Square is a drag on Midtown and the redevelopment will create immeasurable benefits in a rippling effect of investment. A local developer is so much more invested than the current absent landlord situation. I applaud Loebs efforts and desire to do this project.

Second win is the largest contributor (Overton Square) to flooding in the downstream area of Midtown, areas like Bellaire, East End, and Overton Park, will be detaining storm water on site instead of shedding run off into Lick Creek and flooding its neighbors.

Memphis has never been good at requiring developers to adhere to environmental measures that cost development money and neighborhood residents are paying for it every time it rains. This is an opportunity to help solve a problem and spur development and jobs.

FYI detaining water in the Overton Park Greensward will not solve run off, storm water, flooding in areas south or upstream of Overton Park.

Wouldn’t a green roof Cafe be cool on one of the new commercial buildings or the Garage or Hattiloo Theater? A green roof would clean water run off and reduce flooding and be a beautiful outdoor space. I would go there often.

It is a good and prudent investment where people live and in projects that solve quality of life and safety issues like flooding. Look at the these web sites for ideas on storm water detention.

http://www.epa.gov/owow/NPS/lid/

http://www.lid-stormwater.net/

I would like to see less focus on auto-centric development.

http://www.green.autoblog.com/2011/11/17/reminder-fossil-fuels-are-getting-scarcer-says-iea/

If we must support the auto, lets at least do so wisely. Where are the electric charging spots? Where are the solar panels on roofs? Where are the natural gas fueling stations? etc etc etc

Better bang for the buck to build a solid public transit network, support bicycling and walking, and build in more urban density and reduce sprawl.

But hey, a big parking garage is nice too.

As for Lick Creek – Memphis should be putting in bioswales everywhere they can. Every time they repave a street or build a new intersection, every time a new house is built or a building renovated. Bioswales located all over the place are far cheaper and more effective than any massive engineering effort like a massive catch basin…

http://en.wikipedia.org/wiki/Bioswale

Bioswales clean runoff, and slow it’s entry into the creek and river system, allowing for drastically less flash-flooding and more groundwater absorbtion. Pavement just directs water into the creeks causing more flooding.

I would like to see less focus on auto-centric development.

http://www.green.autoblog.com/2011/11/17/reminder-fossil-fuels-are-getting-scarcer-says-iea/

If we must support the auto, lets at least do so wisely. Where are the electric charging spots? Where are the solar panels on roofs? Where are the natural gas fueling stations? etc etc etc

Better bang for the buck to build a solid public transit network, support bicycling and walking, and build in more urban density and reduce sprawl.

But hey, a big parking garage is nice too.

As for Lick Creek – Memphis should be putting in bioswales everywhere they can. Every time they repave a street or build a new intersection, every time a new house is built or a building renovated. Bioswales located all over the place are far cheaper and more effective than any massive engineering effort like a massive catch basin…

http://en.wikipedia.org/wiki/Bioswale

Bioswales clean runoff, and slow it’s entry into the creek and river system, allowing for drastically less flash-flooding and more groundwater absorbtion. Pavement just directs water into the creeks causing more flooding.

The increase in the project is alarming to me. But I agree, the benefits are too many to pass up.

Having just visited Memphis with my family and friends last weekend, we toured Overton Square.

We stayed at the Madison(awesome) and hit BB Kings. Drove over the Sun Records and Stax for a view of the glory days. Part of our group hit the Reverend Al Green’s church for song and worship and paid respect to the Kings, Elvis and MLK.

Driving to Overton Square I remembered hitting Friday’s for potato skins and a cold one back in the 70’s. I remember the feeling we felt that we could accomplish anything. If you scored a Clydes T Shirt you were cool from Dallas to New Orleans.

I hope Memphis figures out how to bring back Overton Square and connect it to the Park and the Theaters. It would be a big add on to things to do when families like mine are deciding where to spend their vacation dollars!

Yep,, I think Memphis may figure the Overton Sq thing, say, in about another 8 to 10 years, when by then the city would have lost more of the tax base to the unincorporated Shelby County, the incorporated suburbs of Shellby, Tipton and Fayette counties…..not to mention the out of state exodus (to Mississippi, and completely out of the region in search for better jobs, environment and lifestyles)

This project should have been up and running 10 YEARS ago ! yep, 10 YEARS ago we’re talking about in 2001 !!!! lol……now how does THAT SOUND ? 2001 !! now perhaps outsiders can grasp exactly how FAR behind Memphis actually is, when compared to other cities’ strides …

Anybody read the huge article in the WSJ about AUSTIN TEXAS ?

They labeled Austin Texas as a “brain hub”.

It was a great article for all those Memphians who “think” Memphis ia truly competitive.

The article states:

“Perhaps the most dynamic city in the recovery, the capital of Texas benefits from a great big university, a thriving tech scene, a favorable business climate, an equally favorable actual climate, and cheap living costs for a city with so much bustle and demand. Thanks to low living costs, it’s been a great place for middle-income families to find work and settle. And they really have. Austin’s pool of middle-skill jobs has grown four-times faster than the national average,……”

“Austin is a “brain hub.” It’s got the eighth highest share of college-educated workers in the country. It’s not like other brainy metros … but in a few years it might be.”

Memphis needs to wake up and stop pretending…it needs to FOCUS on what makes a city a truly competitive, super environment.

Memphis can do it, but it’s going to take TOO LONG, given the numerous, viable options for younger smart workers, and families. OTHER cities will be kicking Memphis’ ass for a very very long time…

Yes, Memphis can do it, but we’ve been saying this since the 1980s…while many other cities were white-hot with intelligence, planning, investment, and critical performance.

Go read the artcile.

In 2001, the pieces were not in place- primarily ownership- that would facilitate the redevelopment of the Square. As the post plainly states, taxes generated by development that depends in part on the construction of the garage will be used to finance the construction of the garage itself. In 2001, there were no plans for rehabilitation of the existing structures at the Square to make them suitable for new tenants nor were there plans for new construction in the area. Thus, both the garage and the new development which it would support were not viable in 2001. It’s actually a very simply concept.

that’s the point, the pieces SHOULD HAVE been in place years and years ago…….maybe you were in Neu Yawk then, or in high screwl in Mamffiss when Overton Square was a destination and “almost ” booming

that’s the problem ! it takes TOO LONG and TOO MANY YEARS for the dumbazz “pieces to fall into place” in Memphis…..and it’s not like that in many many other cities ! just look around !!

Overton square is just another symptom of pinhead planning , lack of foresight, and investment

just like the Airport….

speaking of the Airport, the local pinhead planners need to read a good article in the Wall Street Journal, today, 12/01/2011 about one foreign airport and how true forward-thinking can manifest itself in a city, region or country…..

all of you pinhead local planners should read what Bill Franke, the former chairman of American West stated….Memphis pinheads seem too stupid to figure out what competitiveness requires…..lol

ditton on Overton Sqaure

I see you could not invent a more appropriate response and thus resorted to personal comments. You really should try looking in the mirror from time to time.

wow, I don’t see any personalized comment about any person !

what’s eating on you ?? the only persnoalized reference was about

a guy names Bill Franke former exec at America West Airlines

geezus, looking back at some of the personal attacks (really pesonal) on

another poster, you have no room to complain about that rather innocuous

but accurate post about overton Square and AIRPORTS

again, you are off base

Everybody has SEEN some of the “boneheaded” aka “pinheaded” planning projects laid upon Memphians for the last 25 years

those things obviously came out of the minds of “pinheads”….if you were one of them, then you have been part of the problem…if you were not, then good for you

Anon- the complete and total lack of reading comprehension you display even in regards to your own posts is astounding.

Your lack of accuracy on any front made plain by your inability to provide in data, facts or actual experience to support your uninformed opinions continues to speak volumes.