From Atlantic Cities:

Christmas came early this year for retail giant Sears, which is weighing offers on whether to move from its suburban-Chicago headquarters. Ohio officials have put together a package of incentives worth a reported $400 million to convince Sears to move to Columbus, while Illinois lawmakers are offering at least $371 million for the company and Chicago’s financial exchanges to stay in the state.

In these tough economic times, cities and states are more desperate than ever to attract or retain jobs, and companies are cashing in through tax breaks and other economic incentives. It’s a practice that drives a diverse array of advocates crazy, from libertarians to environmentalists to opponents of corporate welfare. Government officials say they don’t like it either, but as long as even one entity continues the practice, no one else can afford to quit.

“They persist because the states are caught in a collective action system,” says Kenneth Thomas, associate professor of political science at the University of Missouri at St. Louis. “They’d be better off if they all didn’t do it, but as individual entities they’d be better off if they made the offer and it was accepted. Everybody responds, so they’re all worse off.”

Governments offer companies nearly $50 billion a year in location incentives, designed to convince them to either stay put or move, Thomas says. Greg LeRoy, executive director of the research center Good Jobs First, which tracks corporate subsidies, describes the “subsidy industrial complex” of site-location consultants, industry groups and industrial realtors who track, arrange and promote deals between companies and governments.

The result doesn’t create any new jobs, but merely moves existing jobs around while fostering economic war between the states. Earlier this year Ohio was on the losing end of a bidding war over Chiquita, the produce company that’s moving to Charlotte, N.C., based largely on a $22 million relocation offer. In New Jersey earlier this year two companies—Panasonic and Pearson Educational—accepted a total of $184.5 million to move jobs from one part of the state to another.

“It’s job blackmail—threatening to leave and shaking down states and cities to stay,” says Thomas, whose book, Investment Incentives and the Global Competition for Capital, examines the subject. “Collectively governments are giving away all this money but it doesn’t affect the location of investment overall. There isn’t any possibility you’re creating new jobs. Ohio might get 6,000 new jobs (from the Sears deal), but Illinois loses them.”

And though the intra-state bidding wars like the one for Sears receive a lot of attention, it’s far more common for companies to move within a metro area, perhaps a town or two away. Good Jobs First studied subsidized corporate locations in the Cleveland and Cincinnati areas in a report called Paid to Sprawl. Of the 164 companies studied, which employed about 14,500 workers, relocations were overwhelmingly away from the urban core, which limited commuting options and fueled suburban sprawl.

“At a time when states are cutting aid to cities and laying off first responders, there’s a problem when they’re paying companies to move around and not creating new net jobs but definitely cutting into the tax base, especially in cities,” LeRoy says.

There is also a libertarian argument against incentive packages, since the offers place governments in the position of choosing economic winners and losers instead of allowing the market to determine corporate success. “It’s economically moronic, even though it tracks a nationwide trend of Big Government handing over money to selected big businesses,” writes Thomas Patterson, chairman of the Goldwater Institute. “The subsidies are touted as necessary for job growth, to stimulate depressed regions and promote economic development. Unfortunately, they just don’t work.”

Thomas adds that the Occupy movement and concern over income inequality is shedding light on how tax policy often favors corporations. “You have average citizens and taxpayers subsidizing wealthy corporations,” he says, “and a lot of people object to that upward redistribution.”

Both Thomas and LeRoy say there are signs that the situation is slowly improving, with more packages including requirements for wages, job retention and the like. Metro areas in places like the San Francisco Bay Area, Denver and Dayton, Ohio, have reached anti-piracy agreements that curtail the constant movement of companies within a region.

But agreements across state lines have generally failed, Thomas says, because they lack an enforcement mechanism. “The states won’t discipline themselves so the federal government will have to,” he says. He points to Europe, where incentive packages are far less common because they must be approved by the European Commission and because there are caps on subsidy levels.

But history provides powerful examples of the allure of economic incentives. In 1997 consumer activist Ralph Nader teamed with a Republican U.S. congressman to reduce government’s role in corporate welfare. The congressman was John Kasich—Ohio’s new governor, whose office is now courting Sears with hundreds of millions in subsidies.

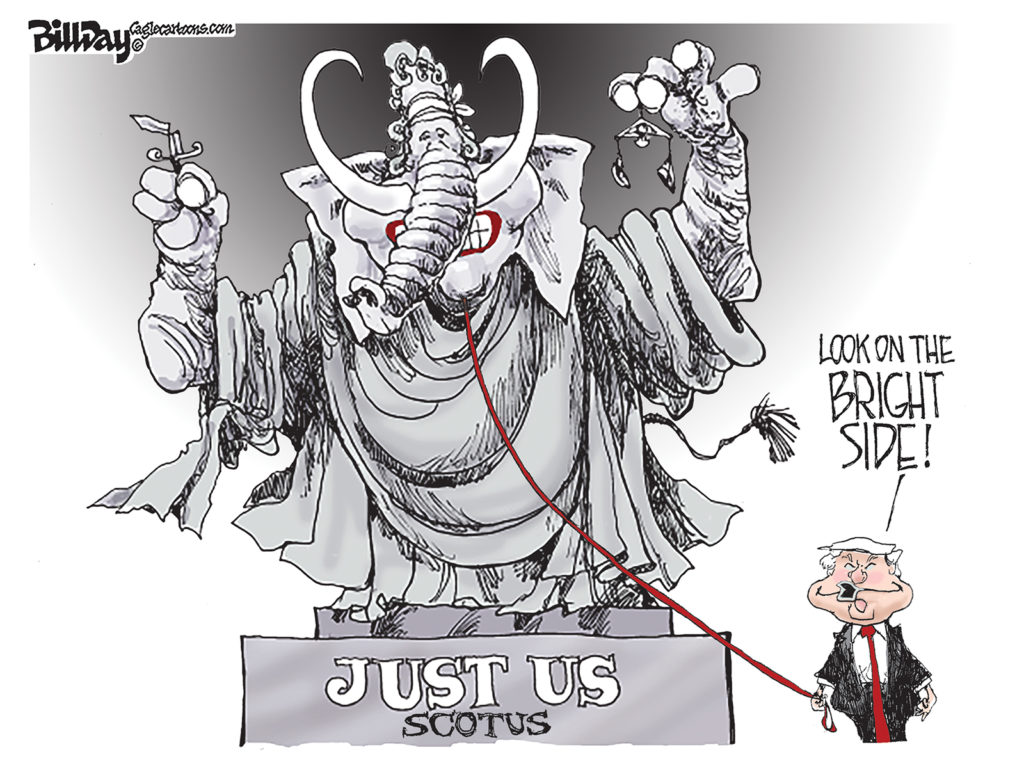

It is going to require the Supreme Court finding that local and state backed incentives and financial medling in the free market represent an unconstitutional manipulation of interstate trade in order to get this pandemic under control.