It seems more than passing strange that at a time when local government is considering a lawsuit against the predatory lending that contributed to Memphis’ foreclosure catastrophe, some members of Memphis City Council would try to defend the predatory lending that is the underbelly of our personal finance businesses – pay day loan companies, title loan businesses and check-cashing storefronts.

It made for an odd tableau at last week’s City Council meeting as high-powered, politically-connected lawyers stood side-by-side with clients who looked like they stepped out of one of those newscasts of people whose trailers had just been hit by a tornado. To their credit, Council members did vote unanimously to move ahead with a change that was almost negligible in its impact, but only after some seemed to try to throw a lifeline to members of these parasitic businesses.

It is troubling what we are willing to accept as part of our city – as long as it’s “only” the poor who are being victimized. City Councils in the past have shamelessly acted as an enabler to the worst visual polluters in Memphis – the billboard industry – and given them carte blanche to pepper inner city neighborhoods with an endless array of ads for liquor, cigarettes and gambling. These billboards deserve greater regulation, but there’s been little will to do it, so we guess that it’s no surprise that some Council members – ironically, representing inner city constituents – seemed to grudgingly go along with a modest requirement that the companies could not be located less than 1,000 feet from each other.

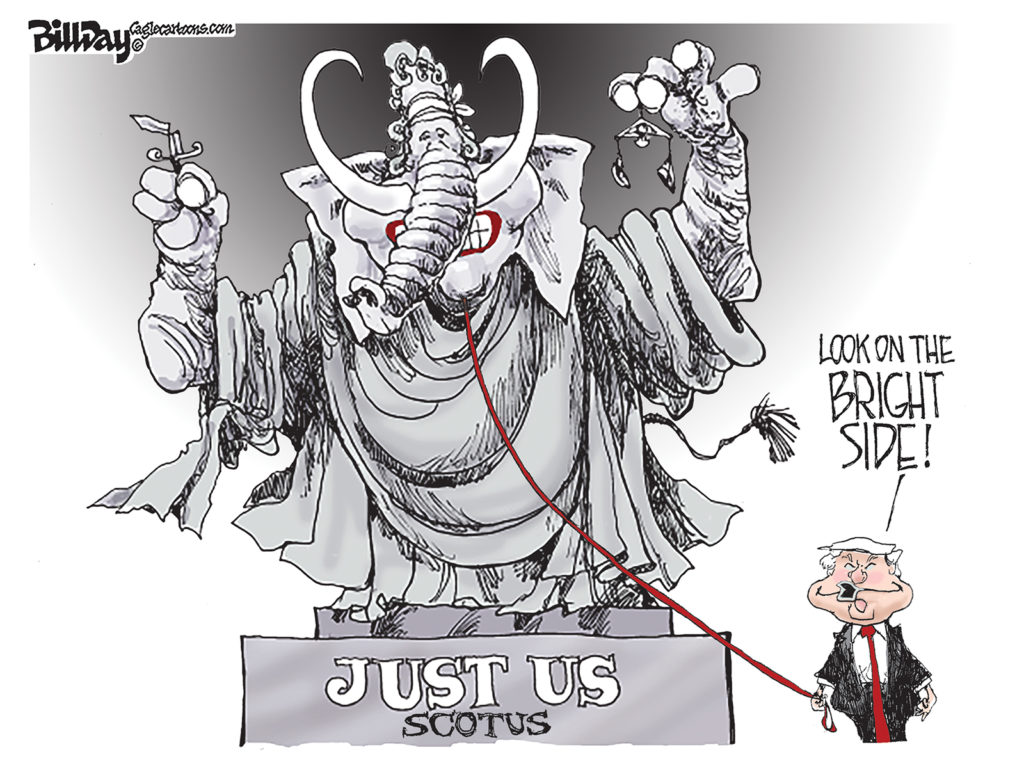

There’s Legal And There’s Legal

We admire Councilman Bill Morrison for putting it on the City Hall agenda. His concern is well-placed, and because of him, we did at least acknowledge the presence of companies in Memphis whose introductions at City Council seemed only to be missing the theme from Jaws, so willing are they to feast on desperate victims trying to keep from downing in financial emergencies.

Councilman Morrison, who is emerging as a reliable voice of reason and source of new thinking, has greater ambitions for regulating the companies, but at least this was a start. It’s hardly a fair fight in City Hall, because for too many politicians, money talks, and as usual, there’s no one lobbying for the poor.

Their neighborhoods remain dumping grounds for tawdry businesses that prey on them and are justified by some Council members on the simplistic grounds that they are “legal.” Well, so are strip clubs, but no one wants them in their neighborhoods.

Naked Greed

As a result, valiant Thomas Pacello, assistant city attorney with the Memphis and Shelby County Division of Planning and Development, was left to reason with some Council members who seemed unable to grasp the simple notion that if government can regulate naked bodies, surely it can regulate naked predatory lending.

Ultimately, the new ordinance will not end the financial strip mining of our poorest neighborhoods, but at least it sends a message, albeit a soft one, that our community is concerned about companies that charge so much in interest that they make usury look inviting. Despite that, Council Member Barbara Swearengen Ware said that “nobody’s holding a gun to these people to make them walk in and hand somebody the title to their car.”

We couldn’t help but think of the famous Woody Guthrie lyric: “Yes, as through this world I’ve wandered/I’ve seen lots of funny men/Some will rob you with a six-gun/And some with a fountain pen.”

Robbery By Another Name

We’re certain that Council Member Ware’s true feelings aren’t as callous as they sounded, because there are places in her district where desperation is as real to her constituents as guns in their backs. And like the “company store” before it, once you start doing business with the loan predators, it’s awfully hard to ever pay off your balance. After all, the business model is built on keeping you in debt.

When the annual interest rate is about 450%, it’s pretty hard not to stay upside down in the loan. Consumer Federation of America conducted a survey of 100 lenders that showed they frequently charged 650%, a rate that stirs up nostalgia for the days of the old Mafia loan shark.

Parenthetically, all of this conjured up the war in the blogosphere some time back when it was pointed out that there was a strong correlation between the number of these pay day lenders and Christian Right strongholds in the Bible Belt, despite the Biblical admonition against usury. Pay day lenders have been able to side stepped usury limits by affiliating with a South Dakota or Delaware-chartered financial institution.

Big Bucks From Poor People

You wouldn’t know it by looking at the sometimes seamy storefronts, but this is big business. According to the Center for Responsible Lending, “despite attempts to reform pay day lending, now an industry exceeding $28 billion a year, lenders still collect 90 percent of their revenue from borrowers who cannot pay off their loans when due, rather than from one-time users dealing with short-term financial emergencies.”

The Center also concluded that “states that ban payday lending save their citizens an estimated $1.4 billion in predatory payday lending fees every year. “ North Carolina shut down payday lending in 2006 and an analysis by the University of North Carolina said that the closing “had no significant effect on the availability of credit for the households of North Carolina.”

To fill the gap in states without payday lending, some credit unions have set up Salary Advance Loans with annual interest rates of 12%. While we are supportive of emulating North Carolina’s actions, it’s unlikely to happen, because, to repeat, there aren’t any high-paid lobbyists in Nashville representing the interests of the state’s low-income families.

Memphis Microcredit

Perhaps, what we need to do here is to experiment with microcredit, the kind of loans that have proven successful for Third World nations. It began in Bangladesh, and there are census tracts in Memphis whose infant mortality rates and other disturbing demographic statistics aren’t too different from that South Asian nation.

Microcredit is even gaining attention of the traditional financial industry, which is considering ways to get in the game.

In other ways, if Memphis City Council wants to help out, it could consider ways that City Hall could help set up some form of micro-lending here. We are willing to bet that just like kiva.org and other micro-lending sites, there are an awful lot of Memphians willing to lend money to allow people to have more financial sufficiency and to engage in self-employment projects.

Memphis Branch Of Kiva

It may be that Kiva isn’t the exact model for our city, because it’s aimed especially at entrepreneurship, but we love the person-to-person aspect of the program. But if we can inspire and create national model programs like MIFA and Church Health Center, and if social entrepreneurs like Aaron Shafer can imagine ways that poor people can control their own destinies, surely we can come up with the model micro-bank for Memphis.

Perhaps, besides offering a new way to address the financial needs that are being exploited in neighborhoods across Memphis by predatory lenders, this kind of program could also contribute to an attack on the divisions that weaken us at the time when community connectivity is a competitive advantage.

We leave the details to people a lot smarter than we are, but put us down to buy the first share in this revolutionary people-to-people business.

Find details in the Payday Loans Questions section.